Accounting is the only way for small business owners to know if their business is doing well and the only thing keeping them out of prison. This is why it needs to be accurate and resilient. No matter what happens, you need to know that the numbers in the books correspond to the real numbers with a 1:1 ratio. Still, how do you achieve this reliability? Here are our top seven suggestions for the ideas you should implement to reap more accounting benefits.

1. Segregation of duties

To commit fraud, one person must have control over multiple accounting processes. It’s like having more than one checkpoint that you have to pass. It’s not about distrusting people in your accounting. It’s just acknowledging that people will be tempted if you make it too easy to alter data and manipulate financial records for personal gain.

By segregating duties, you make this a distant possibility, dissuading many potential troublemakers. Also, by making a whole system more robust, you’ll make it resilient even in the face of staffing changes.

This means that the level of quality remains continuously high and you don’t have to worry about the future, as much.

2. Pick the right platform

Another thing you need to do is choose the right accounting software. The right platform can drastically reduce the likelihood of human error. With the help of an invoice processing API armed with OCR technology, invoices can be scanned. Since there’s no manual entry, the likelihood of human error is drastically reduced.

This also saves labor and allows a single accountant or bookkeeper to do the work of many. You can have a functional accounting department with a good platform, one accountant, and a bookkeeper (or a virtual assistant).

The benefit of this is that you get the functionality of a department even with a skeleton crew. So, your payroll remains low and your accounting improves.

3. Internal control

You need to control your accounting as thoroughly as you can. Just think about it – it’s not just maliciousness you seek. It’s incompetence or errors due to a lack of attention. Do you think that an explanation that you’re not fraudulent, it’s just your accountant who is incompetent, that will stick in court?

You must also stay compliant with regulations and laws, maintain high operational efficiency, and ensure that your financial statements have high integrity. Sometimes, investors or stakeholders will insist that you control your accounting more closely, and you must oblige.

This gives you mechanisms to rapidly discover anything suspicious going on in your accounting, which benefits you from both financial and legal standpoints.

4. External audits and reviews

You can never be too careful. Therefore, on top of the internal control that we’ve already discussed, you also need some independent external verification. The key thing to bear in mind is the fact that these controls are more credible. Internal control can be biased. For this reason, an external audit may even be a regulatory requirement.

Even more importantly, this way, you can control your internal controllers. If the results are not the same, there’s something amiss. This is important since your internal control will conduct a more frequent overview.

5. Careful selection when hiring/outsourcing

When hiring help, you need to be extra careful. Whom are you hiring, and can you trust them? These two questions are pivotal for your selection process, especially when it involves tasks like legal document comparison. First of all, make sure to ask around. Look at their previous employment and their stay in each firm.

There’s so much you can do to research the reputation of the person or agency you decide to work with. The key lies in carefully selecting who you’re working with. There are reviews online, and you can even ask for contacts with old clients.

This keeps track of your own team and helps you make a better staffing selection in the future.

6. Continuous training

We live in a dynamic world. The truth is that regulations change more frequently than they did half a century ago. New tools and accounting practices are also hitting the market every day. Continuous education and training is the only way to keep up with this. These are just not things you can know intuitively.

Also, continuous education will ensure that your problem-solving abilities remain sharp. Your skills deteriorate when not used, and even in accounting, not all skills are present in day-to-day tasks. This way, you’ll just be ready for everything.

Once again, in order to benefit from a system in the long run, you need to make all your accounting methods systemic.

7. Emphasis on data security and privacy

Accounting is always full of sensitive information. This is why you need to ensure that all the data is protected. First of all, your systems need to be sturdy. If your accountants work from their private devices (which is not advised), you must have a firm BYOD policy.

Also, ensure they have strong passwords and never open anything via an unsecured network. This is especially important when it comes to online payment processing. Most importantly, think twice about who you’re hiring. It’s not just their honesty that’s dangerous, but also their recklessness that may put you at risk. Wrap up

In the end, there’s not one of these tips that you can afford to skip and stay safe in the process. You need to ensure that your accounting remains reliable no matter what changes in the legislative or technical accounting field. Also, you want to make this systemic so that nothing significantly changes, even when you hire a new accountant. This way, you’ll get to enjoy these accounting benefits in the long run, not just benefit from them temporarily.

If you found this article helpful, we encourage you to share it on your social media platforms—because sharing is caring! For more information about article submissions on our website, feel free to reach out to us via email.

Send an emailWritten by RGB Web Tech

Latest Technology Trends

Latest technology trends shaping the future, including AI advancements, blockchain innovation, 5G connectivity, IoT integration, and sustainable tech solutions. Explore breakthroughs in quantum computing, cybersecurity, augmented reality, and edge computing. Stay ahead with insights into transformative technologies driving innovation across industries and revolutionizing how we live, work, and connect.

Related Articles - Technology

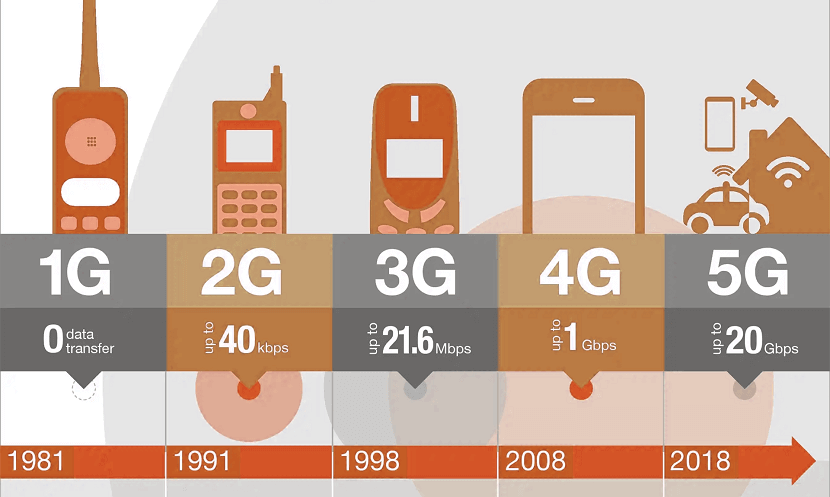

What is 5G Network

What is 5G? Learn everything you need to know about 5G technology and how it will redefine communication, entertainment, and the way people connect ...

Employee Monitoring Software

Enhance productivity and security with SentryPC, the top-rated employee monitoring software trusted by businesses worldwide.

Benefits of Accounting Standards

Enhance your financial management with 7 effective strategies to maximize the advantages of your accounting system. Elevate your business today!

Artificial Intelligence Slides

Unlock AI's power in your digital marketing narrative with dynamic slides. Craft compelling stories that captivate your audience.

AI Content Detection Tools

Discover top AI content detection tools of 2024! Enhance security and streamline content moderation with cutting-edge solutions.

Challenges are Associated with Generative AI Testing

Key challenges in generative AI testing, from data quality to ethical concerns. Learn how to navigate the complexities of testing advanced AI models effectively.

Role of Data Science in Business Intelligence

Unlock business potential with Data Science! Explore its pivotal role in Business Intelligence & decision-making. Transform data into actionable insights.

Role of Snowflake Optimization in Business Success

Unlock business success in the data revolution with Snowflake Optimization. Navigate data challenges seamlessly for unparalleled efficiency and growth.

AI Tools for Teachers and Educators

Discover 3 essential AI tools empowering educators: From grading assistance to personalized learning, streamline teaching tasks effortlessly.

Common Myths and Misconceptions About ITIL Debunked

Unravel ITIL myths! Discover truths behind common misconceptions. Unveil the real essence of ITIL in this eye-opening debunking journey.

Strategic Sales Insights

Gain strategic sales insights for navigating today's business landscape effectively. Unlock success with actionable tactics and expert guidance.

Enhancing Virtual Engagement Leveraging Technology for Smooth Interactions

Discover how to enhance virtual engagement by leveraging technology for seamless interactions. Boost connectivity and collaboration in your digital spaces.

The Future of Business Messaging Trends and Technologies

Explore the future of business messaging with insights on emerging trends and cutting-edge technologies shaping communication and collaboration.

Transforming Retail Spaces with Interactive Digital Signage

Revolutionize retail with interactive digital signage: enhance customer engagement, boost sales, and create immersive shopping experiences.

Unlocking User-Centricity with Generative AI

Explore how generative AI is transforming user-centric design, enhancing personalization, boosting engagement, and revolutionizing digital experiences.

Exploring Python Through Mobile Applications

Power of Python on the go! Learn coding, build apps, and explore Python programming through innovative mobile applications.

How an AI to Human Text Converter is Revolutionizing Communication

Discover how AI to Human Text Converters are transforming communication with natural, engaging language for businesses and individuals.

Benefits and Risks of Using API for Crypto Trading

Benefits and risks of using APIs for crypto trading, including automation, efficiency, security concerns, and market volatility

Top Benefits of Omnichannel Contact Center for Agencies

Discover how an Omnichannel Contact Center enhances customer satisfaction, streamlines communication, and improves efficiency for tech and digital agencies.

Revolutionizing Customer Support with Call Center Software

Discover how call center software enhances customer experiences, streamlines operations, and fosters innovation in the ever-evolving web industry.

Boost Scalability with CCaaS for Growing Businesses

Discover how CCaaS enhances scalability, enabling businesses to handle rapid growth, improve web performance, and optimize operations effortlessly.

Enhancing Web Tech Solutions with Contact Center

Discover how a contact center improves web technology, creating seamless, customer-focused solutions that enhance user experience and satisfaction.

Boost Customer Retention with Omnichannel Contact Center

Explore how an omnichannel contact center enhances customer retention for web-based businesses by delivering seamless and personalized experiences

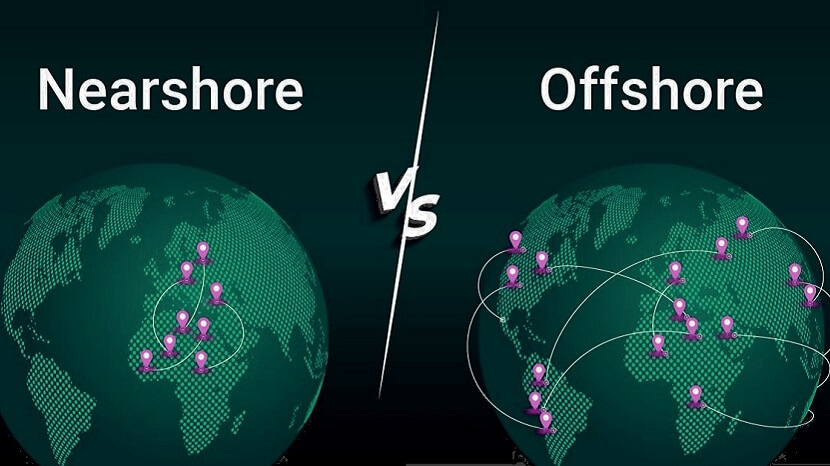

Differences Between Nearshore and Offshore Java Application Outsourcing

Discover the key differences between nearshore and offshore Java application outsourcing, including cost, communication, and time zone benefits.

Innovative Ways AI is Transforming Everyday Life

Discover how AI is revolutionizing everyday life, from self-driving cars and healthcare robotics to smart homes and energy optimization. Explore real-world AI applications driving change.

How to Set Up Your Own WhatsApp Chatbot in Minutes

Learn how to set up your own WhatsApp chatbot quickly and easily in just minutes! Streamline communication and boost engagement effortlessly.

How Open-Source Technology Is Expanding Global Access to Books

Open-source Technology in Publishing, Global Access to Books, Digital Libraries Open Source, Knowledge Sharing Platforms, Affordable Education Resources

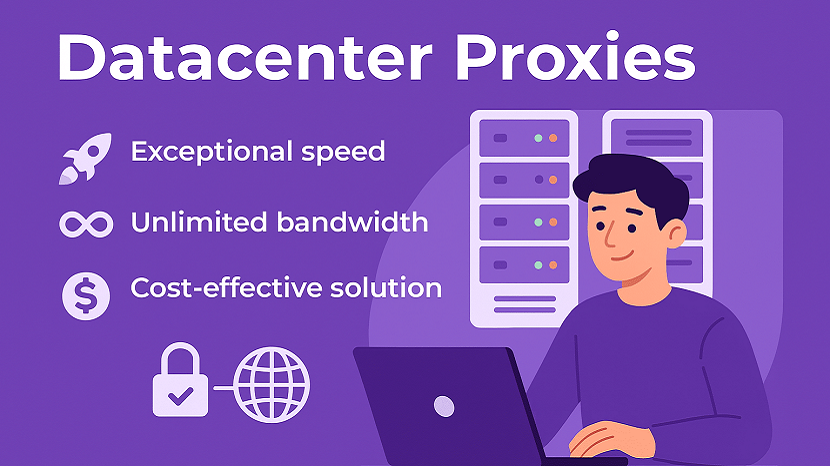

Power of Datacenter Proxies in a High-Speed Digital World

How datacenter proxies enhance speed, security, and performance in the digital world. Learn their key benefits, use cases, and why they’re essential for businesses and tech enthusiasts