Learn how secure online payment processing protects your customers and business from risk and fraud.

There are so many brands and businesses selling products and services online. This makes it easy for customers or consumers to have access to varying choices when they want to make purchases. Customers need the assurance that when they share their payment details online in an e-commerce store their details will not be compromised.

However, hackers are constantly looking for ways to steal the banking and payment details that are shared on websites. It makes it increasingly important for e-commerce owners to ensure that payment processing is secure and that customers’ data are not breached because doing so will lead to a dent in the brand’s reputation. Therefore, we will be sharing with you the 10 best practices that you can implement for secure online payment processing. They include:

1. Match the IP and Billing Address Information

During online payment processing, matching the IP and billing address information is frequently done because it helps to prevent fraud and ensure that the payment is secure. To match the IP and billing address information, customers must first input their billing information while making the payment online; this includes details like their address, city, state, country, and postal code. While this is being input, the IP address of the customer will be simultaneously captured. This IP address is usually a numerical label that has been given to the customer’s device once connected to the internet. With the help of geolocation services, the billing and IP address will be compared to see if it matches. Where this does not match, there is a possibility that it is a fraud and the customer can be notified. Including matching IP address and billing address helps secure online payment processing for both the e-commerce store and the customer shopping.

2. Encrypt Data

Another best practice for secure online payment processing is by encrypting data. With the use of TLS and SSL on the websites, data can be encrypted which makes it difficult or impossible for hackers to access the data and make use of it.

The benefit of using an SSL certificate is that customers can share data securely with a website while trying to make online payments. This data can be the card number, pin, CVV codes, expiration date, and other information that if it falls into the wrong hands, can be bad. Here, SSL can be either domain validated, extended validated (EV) or organization validated (validation types). It depends upon the type of SSL certificate that a payment process has in built. Most payment processors go with an EV SSL certificate that provides the highest authentication and security. Many resellers offer low priced or cheap EV SSL certificate in the market.

When a customer’s browser and your company’s website server want to communicate data between both ends, no hacker can intercept that data. It also ensures there is no interception or decryption of data that is shared with you.

3. Use Payment Tokenization

With the use of payment tokenization, payment processing is made secure. How this works is that immediately the card details are inputted on the seller’s server, and a unique token is assigned to it and used while processing the transaction. This token is often randomly generated and a reference is made between the card details and generated token to keep it safe. Therefore, when this token is being communicated to the seller’s server, the seller cannot see the original information on the card detail, but can only see the payment token. So, it becomes impossible for hackers to access the original card details because of the payment token.

4. Require Strong Passwords

Ask your customers to input strong passwords when they want to sign into the payment option of their website. The password should not be something that can be easily guessed by hackers like the birthdates of the customer or that of their loved ones. It is better if the password is something randomly generated but strong. A strong password is usually eight characters long and made up of numbers, alphabets, and symbols. There are times that up to eight characters may not be accepted, but you should still use a strong password. It is advisable to have a password manager to store your passwords, and if you ever have to click on the ‘forgot password’ option, ensure that the OTP that will be sent is to your email address or the phone number you are currently using.

5. Implement 3D Secure

You have to choose a payment service provider (PSP) that supports and allows 3D secure, because it will help to secure payment processing. When you settle on the PSP, you have to sign up and fully get on to make use of it and that will involve supplying relevant data like business name and banking information. With the 3D secure fully integrated on your website, each time a customer provides their card details to make payments, the request for payment and the cardholder's data will be sent directly to your payment service provider's API.

If their card is enrolled in 3D secure, a redirect URL will be given to them to initiate the 3D secure authentication process where they will be asked to enter a one-time password (OTP). After the customer inputs the OTP, he will be directed to the website to complete the payment process. Some cards are not enrolled in 3D secure and it is usually a bit good because of the high risk and the potential of hackers accessing the data. So, implementing 3D secure will help to secure payment processing.

6. Request the CVV

CVV stands for card certification value. It is usually made up of 3 or 4 digits and at the back of a credit card. Ecommerce store owners have seen and agreed with the need of asking customers to input this CVV code for secure online payment processing. The benefit of customers inputting the CVV is to prevent fraudulent transactions because even when someone can access your payment details if they do not have your card, they will not be able to add the CVV hence the payment transaction will not go through.

7. Use Strong Customer Authentication (SCA)

Based on your state or country, there are different strive customer authentication (SCA) guidelines or procedures that you can make use of to secure payment processing. There are certain monetary thresholds that when it is exceeded, you have to make use of SCA. Therefore, on your website, you have to make use of two-factor authentication, and appropriate authentication methods, which can involve you including third parties, authentication methods on your website.

SCA methods are constantly evolving so for the benefit of your customers you should keep abreast with it and educate your customers on setting up authentication methods and its importance. When your customers have an idea and implement authentication methods, it makes it easier for you both to work together towards securing payment processing.

8. Monitor Fraud Continuously

To monitor fraud for secure online payment processing, you have to make use of real-time monitoring and proactive measures to watch out for this fraud. There are fraud detection tools, address verification systems (AVS), two-factor authentication, chargebacks and refunds, data analysis, and other things you can do to monitor fraud. If you want to monitor fraud in real time, you have to employ a data analyst who can go through all incoming data. Spending the time and resources to do this will help you spot fraudulent activities and any form of hacking attempt during payment processing.

9. Manage PCI Compliance

As an e-commerce store owner or any person who is accepting credit card payments online, you have to comply with Payment Card Industry Data Security Standards (PCI DSS). The standards that must be covering protecting the data of customers and credit cards being used on your website. It ensures that some security systems and networks have been built, and regularly looks out for malicious software that tries to access your website or data. The team should look for who can access sensitive data on your website, each time you notice unauthorized access quickly take notice of it and put a security system in place to prevent an attack and if there is an attack, try to respond immediately to rectify it. Doing all these will help secure online payment processing for your business and customers.

10. Train Employees

Securing payment processing is the work of customers, e-commerce store or website owners, and employees. When your employees are trained on how to secure online payment processing, it will help minimize payment insecurities and hackers accessing sensitive data. So, teach your employees to log out of their accounts when they leave their workstations, not keep work USB drives unattended, and watch out for phishing emails or spam so that they do not click on them. They should not give anyone their accounts or log in details to prevent unauthorized access to their information. Employees should frequently keep abreast of how to secure payment processing.

Rapyd Offers Built-In Payment Fraud Protection with Advanced Features, which will be beneficial to your website or e-commerce stores each time someone wants to make a payment. Additionally, you can download the useful guide: How to Reduce Your Payment Risks for Cross-Border e-commerce. This guide will help you need to secure online payment processing. Know that you can keep or lose your customers online based on the security measures you implement to process payments.

Conclusion

Securing online payment processing is important for a business or brand that does not want to lose customers' data and harm their brand's reputation in the process. So, as an e-commerce store owner, make use of these 10 steps to secure payment processing. Do not fail to keep abreast with relevant and innovative ways to secure payment processing online.

If you found this article helpful, we encourage you to share it on your social media platforms—because sharing is caring! For more information about article submissions on our website, feel free to reach out to us via email.

Send an emailWritten by RGB Web Tech

Latest Technology Trends

Latest technology trends shaping the future, including AI advancements, blockchain innovation, 5G connectivity, IoT integration, and sustainable tech solutions. Explore breakthroughs in quantum computing, cybersecurity, augmented reality, and edge computing. Stay ahead with insights into transformative technologies driving innovation across industries and revolutionizing how we live, work, and connect.

Related Articles - Website Hosting

Web Hosting Service

Looking for an affordable way to host your website? Check out our guide to cheap web hosting services, with top providers and key features compared.

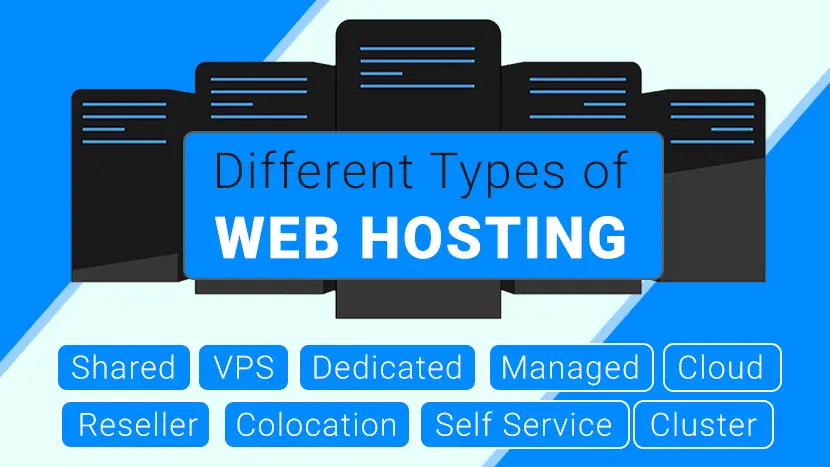

Different Types of Web Hosting

In this article, we will discuss the most popular types of hosting and help you to decide which is suitable for your website.

What is Linux web hosting

Linux hosting is an open source operating system where web hosting services occur with the use of a Linux-based server.

What is Windows Web Hosting

The necessity of having a dynamic website with visually attractive elements has now become an essential factor for many individuals.

What is Shared Hosting

Shared hosting is a type of web hosting where a single physical server hosts multiple sites. Many users utilize the resources on a single server...

What is VPS Hosting

Learn what VPS hosting is and how it works. Virtual server comparison to other web hosting platforms included.

What is WordPress Hosting

Learn about WordPress hosting, one of the most popular website platforms today. Discover the features and benefits of a WordPress website.

What is Dedicated Hosting

Dedicated hosting is a term used to describe web hosting packages that provide a dedicated server with dedicated resources to a single client.

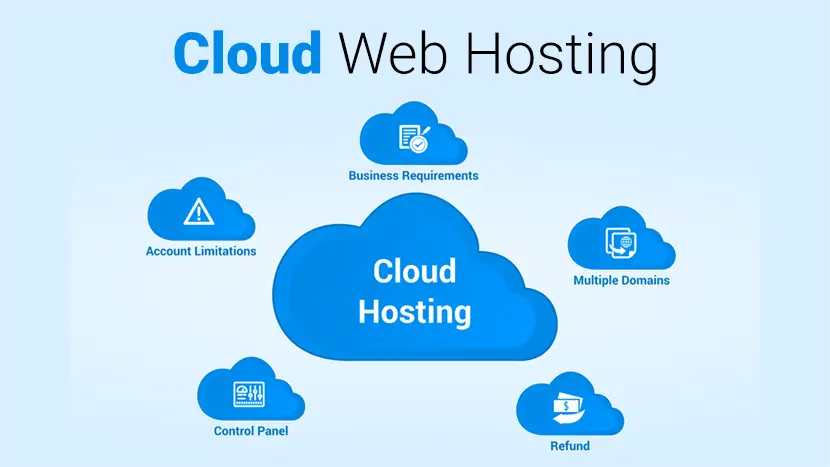

What is Cloud Hosting

Cloud hosting is a type of web hosting which uses multiple different servers to balance the load and maximize uptime. Instead of using a single server..

What is Reseller Hosting

Start your web hosting business with Reseller Hosting! Learn what it is, how it works, and why it's the best choice in this detailed guide.

What is Managed Hosting

Managed dedicated hosting is an IT service model where a customer leases dedicated hardware from a managed hosting services provider.

What is Colocation Hosting

Colocation hosting offers server housing at data centers, where clients own the servers while benefiting from secure space and reliable infrastructure.

What is Self Service Hosting

Self-service web hosting is done completely on your own. This is the most advanced web hosting. You need to have a place to rent that stores your server.

What is Cluster Hosting

Cluster hosting is sometimes confused with Cloud or Grid hosting. It is simply a group of servers that operate together and act as one “mega” server.

What is an IP Address

The internet and networks use the TCP/IP protocol as a means of communication for computers. Each of these computers must have a unique set of numbers...

What is a Domain Name

Are you looking for the best domain registrar to purchase a domain name? See our expert comparison of the best domain registrars.

What is SSL certificate

SSL stands for Secure Sockets Layer. An SSL certificate encrypts all connections that are made to and from your web server, which means...

Wildcard SSL Certificates

Wildcard SSL certificates offer essential protection for multiple subdomains under the same primary domain, simplifying security with a single certificate.

What is FTP

FTP (File Transfer Protocol) allows easy file transfer between computers. Essential for website development, ensuring smooth file management.

What does dot com stand for

In order to understand the meaning of .com, you must learn a few basics. First understand that the .com comes at the end of the webmaster’s domain name...

Advantages of VPS Hosting for E-Commerce Start-Up

Your e-commerce business is ready to go to the next level, but you aren't sure if you should continue with your shared hosting account or upgrade to ...

Best FREE Web Hosting

Although they are not ideal for all sites, knowing the best free website hosting providers can come in handy. Here are 17 of the top picks!

Secure Online Payment

Discover top 10 practices for secure online payment processing, ensuring the safety and protection of your transactions. Enhance trust and peace of mind.

Considerations for Choosing the Best Web Hosting Service

Discover the perfect web hosting with our guide! 10 key factors to consider for the best service. Speed, security, support, and more. Start strong online!

Domains vs Hosting vs Website

Learn the key differences between domains, hosting, and websites. Simplify your online journey with a clear understanding of each element.

Why Elementor Makes Managed Cloud VPS Hosting the Ultimate Choice for Your Website

Discover why Elementor's managed cloud VPS hosting offers unmatched speed, security, and flexibility. Elevate your website's performance today!

Unlocking the Power of Windows VPS Affordable Options Revealed

Unlock the potential of Windows VPS with our guide to affordable options. Discover cost-effective solutions for enhanced performance and reliability.

Web Hosting Services in Dubai A Comprehensive Comparison

Explore a comprehensive comparison of web hosting services in Dubai. Find the best options for reliability, performance, and affordability.

Black Friday Web Hosting Deals A Comprehensive Guide

Find the best Black Friday web hosting deals in our comprehensive guide. Compare top offers to save big on hosting this season.

Boost Your Website with ReactJS Hosting

Boost your website with ReactJS hosting! Discover why it matters for speed, security, and scalability. Optimize performance and enhance user experience today!

Reseller Hosting for Small Businesses

Best reseller hosting for small businesses! Explore top picks, key features, and expert insights to grow your hosting business with ease.

Best Web Hosting in UK

Best web hosting in the UK? Explore critical factors like speed, security, uptime, and support to find the perfect hosting solution for your needs!

How Full Access to Your Virtual Private Server Improves Performance

Gain full control of your Virtual Private Server (VPS) to boost speed, enhance security, optimize resources, and tailor performance to your needs.

Reliable Hosting

How reliable hosting enhances website performance, ensures uptime, and supports long-term online business growth and digital success.